Editor’s note: This editorial was contributed by Christine De La Rosa, co-founder and CEO of The People’s Ecosystem, a California-based and equity-focused multistate cannabis operator.

No one will say it because no one really wants to acknowledge it: the cannabis industry is on fire. We are seeing massive downturns in many first-mover states due to a market contraction and, of course, over-taxation. Still, we’ve known about that for a while and understood the danger that over-taxation poses to small and midsize businesses in particular. This is also an issue for large companies, but the glaring difference is that large companies have access to more capital than small to midsize businesses. Many small to midsize businesses are owned by women, people of color, and immigrants who don’t have access to capital during this or any downturn.

It’s a three-alarm fire. What do we do?

We often say to be in the cannabis industry is to constantly be putting out fires. What actionable items need to happen to put out the three-alarm fire we currently find ourselves in or at least slow it down until federal legalization? Some people would say that means we have to lower taxes, but we aren’t going to see a significant lowering of taxes because states need the money. Despite the rhetoric, there is no state in the union legalizing because of the plant — they are legalizing because of the cash.

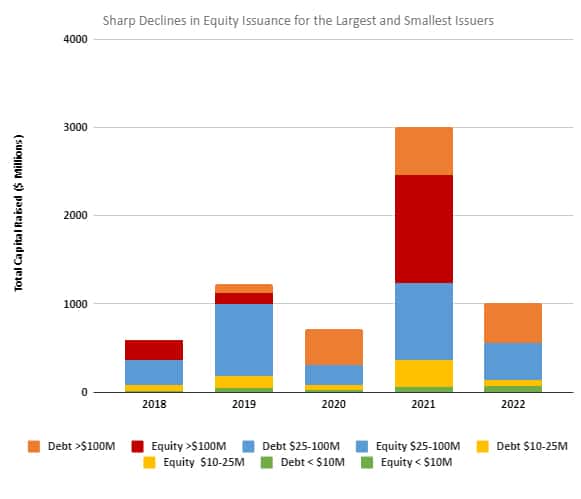

And taxation is not the only fire. Anyone currently raising capital for plant-touching operations knows that it has become increasingly difficult to raise equity funding in the last few months. It used to be that funders were looking for unicorns to invest in. This has shifted, and now businesses are looking for funders willing to make equity investments into small to midsize companies. Those equity funders, well, they have become the unicorns. To say the equity financing has dried up in the last few months is an understatement, as shown by the Viridian graph below.

Equity funding dries up

The bottom dark green bars on each chart represent equity issues of under $10M in size. They have always represented a small fraction of the capital raised in the plant-touching business. This year that bar has disappeared. Small companies are being locked out of the market right before our eyes. The dark blue bars represent deals from $10M to $25M disappearing for mid-size companies. Do you see the area that is lit up? That light blue area shows the debt financing available to a few in the industry. Right now, equity funding is nearly impossible to find if you’re a small to midsize business. Any equity funding that is out there, more than 90% is going to established multi-state operators, who have already gotten a lot of equity funding and lost it. Now the billions of dollars being raised are for debt financing, and this is where the cannabis industry has set itself on fire.

Shifting from equity financing to debt financing as a primary way of funding the cannabis industry is awful, especially considering some of the debt structures being offered. These debt facilities are often complex and punitive, hello 28% interest, or as we call them, payday loans.

Creditworthiness in crisis

But what type of funding is needed? Before we can understand what kind of financial products we should be putting together for the cannabis industry, specifically for small to mid-size companies and especially for social equity companies, we need to understand the failure of our financial institutions. In general, we have to understand the rubric currently used to identify who has creditworthiness for investment, equity, or debt, who would be the most likely to succeed at scale, and who has market share. This does not work in the cannabis industry. It leaves many people getting first licenses behind, which is not an issue in normal industries because there was not a whole marketplace before non-cannabis industries stood up.

We have to begin to open our minds to different ways of identifying the creditworthiness of cannabis companies led by people who have traditionally not been considered creditworthy for anything in the entirety of the existence of this country. We have to value the power of their intellectual property for the last 80+ years, their ability to create and transition a market for their companies, and the innovation they contributed and continue to contribute to the industry. They have a true value which is a bang for your investment buck.

When considering this in terms of upcoming recreational states, we have to look at New York.

What will New York do?

To use the creditworthiness rubric as it exists today in the cannabis financing industry is to understand that equity (ideal) and debt (less ideal) funding does not exist for the people getting the first licenses in New York. It certainly did not help those who got their first licenses in California. It also hasn’t helped the social equity people that came as an afterthought in Colorado and other states. We need new, creative financial products that are more equitable without giving up reasonable-to-excellent returns. We need to create a thriving legal marketplace, not just in New York but across the U.S. We have to change the rubric funders, financial institutions, and foundations use in the future to truly underwrite this groundbreaking industry and equitably provide financial products for people less likely to qualify but more likely to be successful in the cannabis industry.

Although New York is starting with a $200 million debt fund, it is for real estate, not for start-up or the OPEX capital that will be needed to actually open a retail store. Without the cost of real estate, starting a cannabis retail shop takes anywhere between $1 to $2.5 million to open the doors. Then add 30% to that number for New York City.

Where will this capital come from, and in what form? What are the options for low-cost start-ups and OPEX capital? And where do we start?

Financial education beyond Quickbooks

We start by providing financial education on how to run a capital-intensive business beyond just using Quickbooks. The financial sector, which is putting together equity deals, debt facilities, and everything in between, needs to talk with formerly incarcerated people, BIPOC, or women at scale to see what they need from their financial products. Financial products should be solving a problem, not creating a new one. What good is a golden ticket if you can never use it because you don’t have access to equitable capital, and the capital you do have access to, you may not understand how to take full advantage of it, or it can be so detrimental that you risk losing your business? Building capital stacks for every possible eventuality is not something that is taught to new founders coming into this complex industry.

On the flip side, funders must create attractive financial products that support the entire industry, not just a select few. And last but certainly not least, governments — local, state, and federal — need to prepare to step up and step in to create the low-interest loans and grants required to stand up a new industry, as they did for electric cars, solar power, wind, steel, railroads, etc., but that’s my next op-ed.

Continuing to act like the cannabis industry is like any other industry is to continue to fund an industry that will not realize its full potential. This will be reflected in the bottom line of your investment dollar. It is in the best interest of the industry and its investors that small, medium, and large operators exist synergistically. We must all work together to move together, or we will remain a fractured industry and marketplace that willingly contributes to a continued prison pipeline for the very people who built the industry.

Get daily cannabis business news updates. Subscribe

End