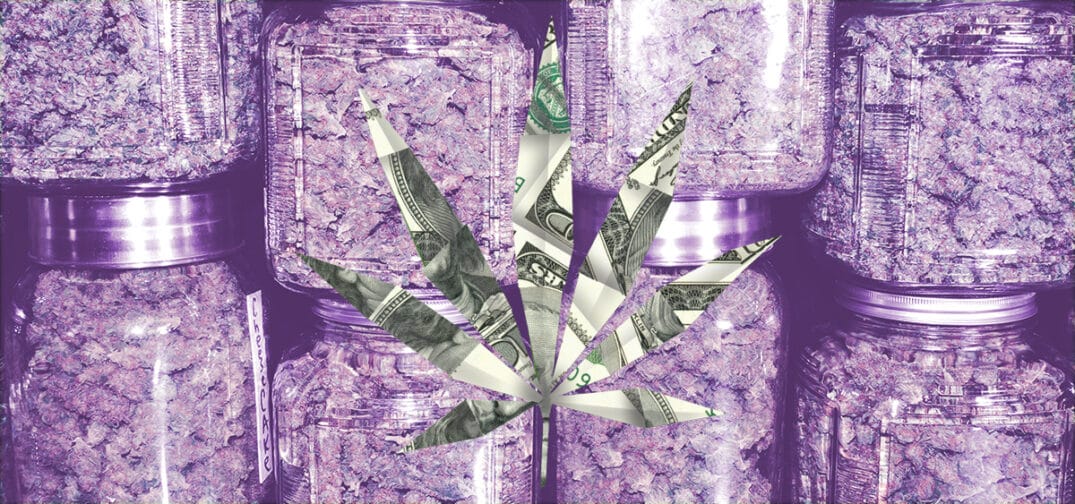

California is set to raise the state’s cannabis industry tax from 15% to 19% — a 24% hike — starting July 1 under a plan being implemented by Gov. Gavin Newsom (D), according to an SF Gate report.

The California Department of Tax and Fee Administration announced the tax hike last Thursday.

The incoming hike will lead to the highest cannabis tax rate legally allowed under state law, per a 2022 proposal signed by Gov. Gavin Newsom (D) that removed a blanket cultivation tax but included a provision requiring the tax rate to be raised if cannabis tax revenues were to fall. Since then, tax revenues in California have dwindled as the legal market struggles against strict regulations, competition from the illicit market, and already high taxes.

Jerred Kiloh, president of the United Cannabis Business Association, said in the report that the tax hike will create even more turmoil for the industry.

“More businesses will close sooner as the legal price is just too far away from illegally obtained products. Less investment in starting or continuing cannabis operations will occur, and demand for cannabis licenses will decline exponentially.” — Kiloh, via SF Gate

Get daily cannabis business news updates. Subscribe

End