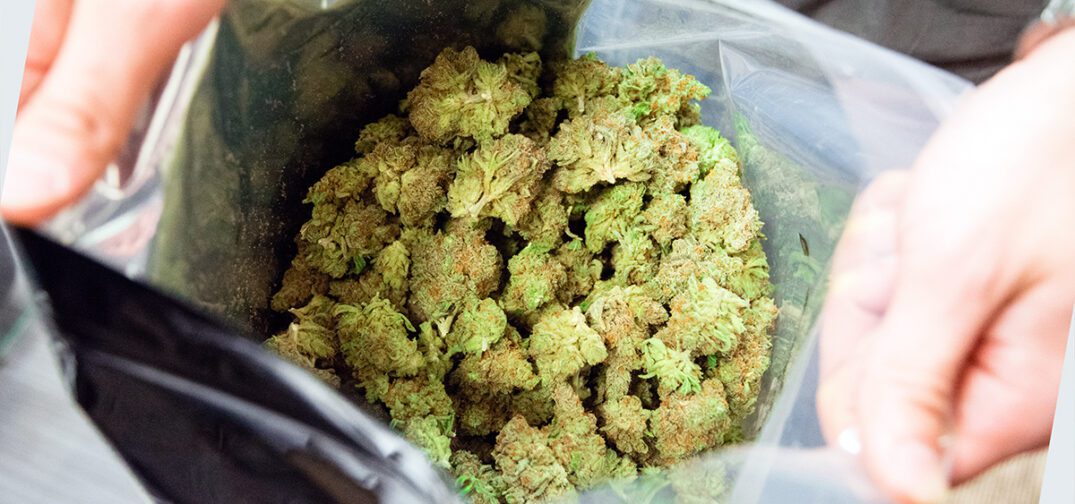

Oregon per-gram cannabis prices have fallen 16% from last year to $4 at the start of this year, according to the Oregon Liquor and Cannabis Commission’s 2023 Recreational Marijuana Supply and Demand Legislative report. The prices in the state are now at an all-time low.

“The OLCC estimates that market demand was 52% of supply in 2021, and 63% in 2022. The fact that 2022 was closer to supply/demand equilibrium than 2021 stands in contrast to the deteriorating market conditions. On the one hand, the fact that supply was closer to demand is a reflection of the decrease in annual production by OLCC Producers in 2022, a self-correction in the market that offers a glimmer of hope for 2023. On the other hand, the declining wholesale and retail prices for usable marijuana are due to large stocks of usable marijuana inventory leftover from previous years, which is likely to continue to put downward pressure on prices.” — OLCC, “Recreational Marijuana Supply and Demand Legislative Report,” Feb. 2, 2023

The agency found that the total quantity sold of usable cannabis increased in both 2021 and 2022, but the OLCC described the increase as “a fairly tepid rate.” The increase in 2022 was 2% in 2022 and just 1% in 2021, compared to a growth rate of 27% in 2020.

“The quantity sold of concentrates/extracts, edibles, and tinctures, on the other hand, declined in 2022,” the agency said in the report. “Because of the diversity of products in the market, it is difficult to do an apples-to-apples comparison of quantities sold from one year to the next.”

The agency notes that the state saw a sales increase from 2020 to 2021 – from $1.1 billion to $1.2 billion – but decreased to $994 million last year. Monthly sales last peaked in April 2021, the agency said, but have declined every month since, save for a spike in August 2021.

According to the OLCC report, the abundant cannabis supply in 2021 and the declining prices throughout 2022 placed cannabusinesses under “severe strain.”

Despite lawmakers placing a moratorium on producer and retailer licenses, the OLCC said the number of producers and retailers are “now at their highest levels ever.” While the moratorium applies to new licenses, some applications eligible last year had been first filed in 2018. The agency said that while the number of licenses continued to rise last year, the number of active businesses “continued to decline.”

The OLCC does see “positive signs of improved (or at least, less bad) market health” this year, pointing to a less steep decline in retail prices and “relatively strong” sales of edibles – a product sector which saw a modest 0.2% growth last year.

“The Oregon recreational marijuana market has repeatedly shown that it is like any other market in one important respect, but unique in another,” the OLCC said in the report. “Like other markets, it is responsive to market signals and ramps supply up or down depending on demand. Unlike other markets, however, the federal status of cannabis means that Oregon is what has been termed a ‘market in a box’ – supply must stay within the state’s borders, despite its strong comparative advantage in cannabis production.”

Get daily cannabis business news updates. Subscribe

End