Vermont was the first state to legalize cannabis without relying on the ballot initiative process. The landmark bill, however, stopped short of establishing a regulated adult-use marketplace in the state, which has led to a lot of consumer confusion and resulted in a bustling cannabis gray market.

In this podcast interview, Vermont Cannabis Solutions founder Tim Fair joins our host TG Branfalt to discuss prospects for a future Vermont cannabis marketplace, the state of its medical cannabis and hemp CBD industries, the meddling of federal law enforcement agencies in local cannabis issues, and more.

You can listen to the interview below or through your favorite podcast platform, or scroll further down to read a full transcript of this week’s episode of the Ganjapreneur.com podcast.

Listen to the podcast:

Read the transcript:

Commercial: At Ganjapreneur, We have heard from dozens of cannabis business owners who have encountered the issue of canna-bias, which is when a mainstream business, whether a landlord, bank, or some other provider of vital business services refuses to do business with them simply because of their association with cannabis. We have even heard stories of businesses being unable to provide health and life insurance for their employees because the insurance providers were too afraid to work with them. We believe that this fear is totally unreasonable and that cannabis business owners deserve access to the same services and resources that other businesses are afforded, that they should be able to hire consultation to help them follow the letter of the law in their business endeavors, and that they should be able to provide employee benefits without needing to compromise on the quality of coverage they can offer. This is why we created the ganjapreneur.com business service directory, a resource for cannabis professionals to find and connect with service providers who are cannabis friendly and who are actively seeking cannabis industry clients.

If you are considering hiring a business consultant, lawyer, accountant, web designer, or any other ancillary service for your business, go to Ganjapreneur.com/businesses to browse hundreds of agencies, firms, and organizations who support cannabis legalization and who want to help you grow your business. With so many options to choose from in each service category, you will be able to browse company profiles and do research on multiple companies in advance. So you can find the provider who is the best fit for your particular need. Our business service directory is intended to be a useful and well-maintained resource, which is why we individually vet each listing that is submitted. If you are a business service provider who wants to work with cannabis clients, you may be a good fit for our service directory.

Go to Ganjapreneur.com/businesses to create your profile and start connecting with cannabis entrepreneurs today.

TG Branfalt: Hey, there, I’m your host TG Branfalt and thank you for listening to the ganjapreneur.com podcast, where we try to bring you actionable information and normalize cannabis through the stories of Ganjapreneurs, activists, and industry stakeholders. Today, I’m joined by Tim Fare. He’s a friend of mine, a friend of the show now. It’s his second appearance. He’s a Vermont based attorney and founder of Vermont Cannabis Solutions. He advises canna-businesses in the state and also defends individuals accused of cannabis-related criminal offenses. How you doing man?

Tim Fair: Doing great. TG, thanks so much for having me on.

TG Branfalt: No, it’s always a pleasure to see you. You’re still in Burlington, while I have absconded deeper into the mountains. So we don’t get to talk or see each other that much anymore, but it’s great to have you on. We have a lot to talk about there’s a lot going on in Vermont, and you’ve done a lot since legalization. The gray market legalization has occurred in Vermont, but before we get into all that sort of stuff, remind people about your background and how you ended up in the space.

Tim Fair: Well, I graduated from law school in 2012, went into criminal defense. And prior to that, kind of my previous incarnation, I was pretty strongly into advocacy for drug policy reform. This is something that has always been a passion of mine ever since college back when I was 18 years old and attempted unsuccessfully to form a chapter of NORML at my community college in Long Island. This is something that I’m just been passionate about. I felt that the United States drug policy has been wrong. Viewing drug use and addiction as a criminal behavior, as opposed to a health concern. This to me just never died. And once I have the opportunity to go to law school and graduate and become an attorney, this was something I’ve had a passion for. So after a few years of learning the ropes, I made the decision to transfer to an area that I felt I could actually have an impact in terms of a … drug policy.

TG Branfalt: So I think the last time that we spoke, legalization was either on the verge or had just passed, but there was no implemented recreational market as you know, and most of our listeners know. And so what is your role been post-legalization in Vermont as it relates to advising businesses?

Tim Fair: Well, you’re exactly right. We passed legalization in 2018 here in Vermont and we legalized our possession of up to an ounce. We legalized home grow of up to the six plants to mature for immature. However, what we didn’t do was legalize any sort of tax and regulated system. So it’s legal to possess. It’s legal to consume. It’s legal to grow a little bit. It is not legal to buy or sell cannabis anywhere here in the state of Vermont. So over the past two years, we have been focusing on kind of two prongs, A developing of our hemp and CBD industry, which we have a thriving industry here in Vermont, thanks to so really great regulation from our department of agriculture, who really supports the industry while at the same time, trying to move forward a tax regulated bill so we can get the commercial marketplace here and that’s posed, of course, its own unique challenges.

TG Branfalt: Well, so let me stop you right there real quick. Just yesterday it came up in a committee, am I correct? And there’s still a pretty big gap there between… What’s the holdup right now?

Tim Fair: Lots. COVID, for one, and we just still don’t have a reconciled bill. There’s still a lot of resistance within our legislature. The speaker of the house, Mitzi Johnson, who happens to be a Democrat has never been on board with cannabis. She doesn’t like it. She’s never liked it. She doesn’t try to hide that she doesn’t like it. And she has really been a roadblock in getting this moved in a quick fashion, but we are seeing movement, basically this conference committee, which the job of this committee is to reconcile the Senate version and the House version of our tax and reg bill, which have very, very different provisions in them, to come up with one final bill, which would then get submitted to the governor. This committee was formed on March 13th, our legislature shut down to COVID on March 15th.

So there was some questions if they would ever have a chance to convene. Yesterday, they convened for the first time. They spent about three hours kind of discussing where the Senate was, where the House was, determined that there were some very big gaps in what they wanted to see, but the movement of just the committee meeting and starting to just work. That was probably the most positive sign we’ve seen in awhile. Two weeks ago. I would’ve said this bill is dead in the water. Now I would say, it’s not dead. It’s still in the water, but we at least see some signs of life.

TG Branfalt: Did lawmakers say anything to the effect during that committee meeting that the state was facing any sort of financial deficits from COVID, which most States are, especially, smaller rural States? Is that part of the impetus or is it just sort of trying to finally let the horse out of the gate?

Tim Fair: I think a little bit of both. The problem is that the state received from their tax department, a estimation of revenue from this bill, which in my opinion, was massively underestimated.

TG Branfalt: What was that? What was that?

Tim Fair: Massively underestimated.

TG Branfalt: What was the figure?

Tim Fair: They anticipate that it’ll take four years before we see any sort of return on the initial investment to get the program started? And they’re saying the amounts will be in one to two million in tax revenue a year based on 20 to 30 million of sales a year.

TG Branfalt: Meanwhile, just to sort of cut you off real quick. Meanwhile, Massachusetts is raking money from New Yorkers, people from New Jersey. So you’d wager to guess that that same sort of influx of out-of-state customers would be coming to Vermont.

Tim Fair: They extrapolate it out from Oregon sales based on one year and then factored in the population change, and taking it to none of the considerations that Oregon and Vermont are very different places.

TG Branfalt: Well, Washington is right there. There’s legalization and…

Tim Fair: Right. But unfortunately a lot of the legislators are using that base. So they don’t yet believe that there’s going to be the income that we believe there will be from this. But there is a strong understanding that the status quo just simply can’t exist. Again, we have this kind of very, very, very loose legalization law that leaves all a lot to be interpreted, a lot that is just not addressed, not answered. They talk about you can have an ounce of flower or five grams of hashish, nothing about concentrates, nothing about that. So what does that mean? Hash? We’re guessing it is, but there’s just a lot that is very unclear, which has made moving forward with our industry very difficult for entrepreneurs and small businesses.

TG Branfalt: So let’s talk a little bit about some of the sort of strangeness of the setup that you guys have there, you described the cannabis laws earlier. So criminally, what charges have you been hired to defend? Well, you have possession of an ounce. You can grow six plants. So you know what charges are state, local law enforcement officials are bringing against people under this regime?

Tim Fair: So it really is interesting. I don’t want to get too much into the weeds, but Vermont has 14 counties. Each County has its own elected state’s attorney. So you have 14 separate States attorneys, who have an unbelievable amount of autonomy to pursue the agendas that they feel are most important. So in certain counties, such as Chittenden here in Burlington, we’re not seeing a whole lot of state prosecutions for cannabis. In other counties with different minded States attorneys we are. So in the last year, just since legalization, I’ve had to defend a husband and wife, husband is a medical marijuana patient and veteran, Navy veteran with diagnosed PTSD and a hemp cultivator who was charged with felony cultivation for cultivating three, what the state police call mature plants, one plant over their limit, which technically isn’t even a felony. Yet him, and his wife, who nothing at all to do with his grow operation, were both charged with felony counts.

We had a great resolution on that. We ended up after quite a bit of back and forth getting the state’s attorney’s office to drop those charges, but not without a lot of work to get put in to convince them to do so. We’ve seen CBD oil manufacturers being arrested when law enforcement believes that what they’re putting together is illegal. There’s a lot of, I’m not going to say it’s intentional, ignorance on the part of law enforcement, but there was a lack of really a full understanding of the differences between hemp and marijuana, CBD and THC. There’s still a huge learning curve. And a lot of this law enforcement will just go in, proverbial guns ablazing. And that’s what we’re still dealing with because in this lack of regulation, there are so many open questions that it makes it very difficult for anybody to be operating on the right side of the law because some simply don’t know what the right side of the law is in a lot of occasions.

TG Branfalt: Well, so in one of the cases that sort of a, I don’t want to say it drew sort of national attention, but it did — there was so many moving parts — and it involved federal law enforcement officials. Am I correct?

Tim Fair: Absolutely.

TG Branfalt: We were talking about the case of a guy named Big John, well-known in the community has a skate shop. I don’t know if he ran for mayor, but people really want him to be made with sort of some of the graffiti you’ve seen, stuff like that. So tell us about that case, how the feds got involved. And it’s a really interesting case. There’s a lot of moving parts and the resolution you got was… I mean, goddamn. So just walk us through that, man.

Tim Fair: Okay. There are a lot of moving parts and I think before we can just jump right into it and kind of need to set the stage a little bit and understand the context of which this happened. John has run Riding High, which is a local skate shop, for the last almost 20 years. He’s amazing, and he has worked with now two generations of kids learning to skate. This has been a passion of his, but John’s their pro skater. He took a nasty, nasty fall, suffered a pretty significant TBI about a decade back, recovered, came back, stuck with it. He’s a great guy, and he happens to be a very strong advocate for cannabis. He believes it’s a healing flower. He believes that it helped him recover from his accident.

And he believes in the positive aspects of cannabis. He makes no hint of how, which unfortunately has resulted in quite a few run ins with law enforcement over the years, where one occasion police came into investigate the reports of a grow as there’s they’re in what as big John do? Big John pulls out of joint lights it up. They’re like, “Big John, you can’t do that.” Like, “Why, it’s my healing medicine.” And John, he wears his heart on his sleeve. He’s an amazing guy. So unfortunately this has created quite a record building up on him. Now, flash forward to 2018, where here in Burlington, legalization has passed and there was an incident with a retailer, not Big John, but another retailer up on Church Street, which is the main tourist drag of Burlington, an open-air pedestrian walkway with shops, decided to start selling amongst other things, marijuana, edibles, allegedly some other substances as well out of his shop on Church Street, directly across from city hall.

And this went on for quite a few months and it pissed a lot of people off. The state didn’t seem to be interested in prosecuting, and we can talk about why that is, but lo and behold, the state did not. And eventually the feds just decided they’d had enough. This was blatant. This was well-known. There were lines right out the door. It was under aged children were having access, no ID. There were reports of firearms being involved, and this was a mess. I don’t think anybody should ever be arrested for marijuana. This was a lot harder than that. So after that there was kind of a shock amongst the town like, Oh my God, this was going on. And it was at that time that I do believe roughly that the feds also began investigating Big John. Now Big John’s shop, Riding High, completely different part of town, down on Battery Street.

The allegations were that he was selling some cannabis out of his store as well. The fact showed that there was ID, there was never any sales to minors. There was never any firearms involved. There was never any other type of substances involved, but the feds decided to begin an investigation and conducted a 16-month investigation into Big John.

TG Branfalt: That’s a hell of a use of federal funds.

Tim Fair: Six undercover buys. You know what the largest buyer was? $40. $40 worth of marijuana was their big bust, several $20 sales. I believe it was a $30 somewhere. After 16 months, 6-7 undercover sales. God only knows how much surveillance time. Yep. A raid a Big John’s house, his business, his property up in upstate New York, and him on his longtime partner, Samantha, were both arrested by federal agents and charged with multiple felonies for a case that honestly, even in 10 years, the feds should never be involved in this. Never.

TG Branfalt: This is DEA?

Tim Fair: This was Northern Vermont drug task force.

So a combination of DEA and local, deputized law enforcement. So yeah, that’s in the middle of an opiod epidemic, in the middle of some really serious issues. This is how the US attorney’s office in Vermont chose to utilize limited resources. And the reality is that unfortunately, we were able to keep Samantha, who was charged with both conspiracy and production, possession of edibles, she started a CBD edible company. There are a couple emails that they claimed were THC. We kept her out. John ended up having spent eight months in pre-trial detention. If it wasn’t for COVID, he may not have gotten out. His was represented by my old mentor, my former boss, Paul Balk, incredible defense attorney. The two of us worked together. I represented Samantha. He was able to get John released on a COVID concern. And when we finally went to sentencing, we were able to get probation for both Big John moving forward, and Samantha, no additional jail time for John, which was an incredible outcome.

I do wonder if not for COVID, that we would have gotten that resolution, but we did. And in a way we hope that after a 16 month investigation, after the tens, maybe hundreds of thousands of dollars spent on this investigation to end up with two probation sentences. Maybe this might show the US attorney’s office that their resources would be spent in a different area. But it really does show that at this point in time, anybody is fair game. And one of the things we’ve seen as a result of this kind of half legalization measure here in Vermont is an explosion of the black and gray markets. Some people going into business, trying to be on the right side of the law. And then some people go into business with no interest of being on the right side of the law, just taking advantage of the opportunities that they see and this half-assed legalization.

TG Branfalt: So with the big John Case, do you think that this would sort of have any impact on how officials may go forward with investigations and things because of the outcome that you were able to get? These guys doing probation, they didn’t get a bigger fish out of all this, right? The result isn’t really sending a message to other people, right? Probation for many people may be worth the risk. What do you think about that?

Tim Fair: Absolutely. That is the hope. If there’s any silver lining to this type of situation, if there’s any good that can come from the unbelievable disruption and impact on John and Samantha’s lives, the unnecessary, unwarranted intrusion and impact on their lives, which was significant and substantial. If any good can come of this, it’s a hope that the prosecutors, the powers that be will look and see and go, “Wow, we spent a lot of resources. We spent a lot of money a lot of time, and this is what the end result was. Did we prove our case? Yes. Did they plead guilty to selling some small amounts of marijuana to adults? Yes. Great. Was that worth it?” Interesting, going back about a decade, decade and a half, if you remember operation Pipe dreams, the FBI spent the single most ridiculous use of money over a million dollars to prosecute Tommy Chong.

TG Branfalt: Well, I was working in the paraphernalia industry when that happened, and the simple fact that it sort of led to nobody being able to say the word bong. It’s ridiculous.

Tim Fair: True, but it also led to a stopping of those type of prosecutions.

TG Branfalt: That’s true.

Tim Fair: Because the amount of resources that were spent for the result, putting Tommy Chung in jail for a while a month or two, and over a million dollars on that particular investigation. So in a parallel, we’re hoping that that will be kind of this, whether it was 50,000 whether it was 100,000, we don’t know how much they spent over 16 months. But with seven buys, with the overtime hours, with the surveillance, it was significant for what ultimately ends up being two probation sentences. The powers that be, hopefully a little bit of common sense would say, “You know what, maybe our resources are better spent somewhere else.” That’s the hope. We have yet to the wait and see what happens. One of the things, however, that the chief justice, the judge, in this case, who was the district of Vermont chief federal judge, one of the things she said was this type of behavior was not legal under state law.

So I don’t want to hear that, and it wasn’t legal under federal law, but she made a point of emphasizing the fact that sales of marijuana still are not legal in the state of Vermont as justification for the investigation and for the prosecution. So this is, again, if we could legalize, if we could establish a taxed and regulated system, now people have a very clear line. They know what they can do and know what they can’t do. And entrepreneurs and business people like John and Samantha would have a route to be able to apply, receive, and get an adult-use dispensary license.

TG Branfalt: Well, is this the biggest issue facing current Vermont, legal operators, right? People who are operating in the hemp and CBD industry. Is this gray market even though it doesn’t really impact them legally because they’re operating within the confines of both federal and state law, is this still the biggest issue facing current Vermont operators? Or is there sort of something else that may be more of a factor, I guess?

Tim Fair: For right now, there is a pretty big distinction between our hemp and CBD industries and the potential adult use industry, and the hemp and CBD industries have their own issues. Most of those on the federal level. And that is the USDA regulations coming out, being just simply unworkable, they had put forth that there needs to be a 0.3% total THC threshold for hemp, which would include THCA. And don’t want to get too much into the weeds on this, but basically putting forth a regulatory scheme that is unworkable for any hemp farmers.

TG Branfalt: Well, didn’t Vermont propose a 1% limit on THC to be considered industrial hemp?

Tim Fair: Yes. And that is under the pilot program are currently operating for this year. Unfortunately, the authorization for that pilot program runs up October 31st. So that will be good for this season. And for everything harvested this season. A big question, and a lot of concern is what happens next season? Will USDA change this or not? Because again, our authorization to act under our 2014 pilot program ends on the 31st. Vermont is a very strong advocate of the 1% total THC standard, which I think is still ridiculously low. However, it is workable. That can be met. A 0.3 on total, it’s ridiculous.

You’ll have to burn every crop. So that’s kind of the big thing right now on the implementation of these USDA regulations, sampling, lab results, not having a robust laboratory system yet, not having any clear standardization for testing. Do we test wet, do we test dry? What’s 0.3? There’s still a lot of open questions within the hemp and CBD realm. So those are kind of separate from our adult use. And frankly, it’s interesting because the hemp and the CBD are looking more at the federal side, the USDA, because there have been regulations at the federal level, while our adult use industry is looking solely at state law, obviously because we have seen no federal motion there.

TG Branfalt: How tough has the last couple of years been for you as an attorney having to figure all this shit out as it comes along?

Tim Fair: I love it. It’s interesting. It’s challenging. Learning this stuff is not the bad part. I love that. Especially at least with tax and reg here in Vermont, the challenges are significant in terms of A, we’ve got 60% approval, but that leaves about 40% who are still opposed. So we have a very strong prohibitionist contingent here in Vermont, more than most people would think. And there’s also internal conflict within the community about S.54 in particular and our tax and regulated bill. There are a lot of cultivators who are very against any sort of regulatory scheme in this bill as well, for some, for very valid reasons and others for some misinterpreted reasons. So it’s kind of fighting a two-front war. We’re trying to explain and deal with the prohibitionists while at the same time, almost having a civil war within the own cannabis community about whether or not tax and regulate as it’s currently proposed is going to be good for the state. So that’s …

TG Branfalt: Do you mind telling me where you stand on it? Do you want to…

Tim Fair: So, as you may or may not know, Vermont was the first to pass legalization, legislatively. Since then, Illinois did as well, different set up than we have here. We didn’t get to do it by ballot initiative. We don’t have the option for ballot initiative. So as a part of any legislative solution, any laws that get passed in a legislative fashion requires compromise. I understand that, I do, there are going to be provisions that we’re going to have to hold our noses and accept in order to get it across the finish line. At which point, once we establish a cannabis control board, now we can start petitioning to try to make the changes that we need to. That is what I do believe needs to happen if we’re ever going to get it over the finish line. However, there is a strong contingent that says, no, we can’t fix it later.

We need to fix it first and pass a better bill. In an ideal world, yes. Is that legislatively going to work? It’s simply not. We have 40% of prohibitionists and in order to get the votes needed again, this is the legislative process and it’s not always great. And sometimes the compromises are not what we would ideally make, but I’ve also been working on this for almost four years. We really started trying to get a taxed and regulated system moved in 2016 for decriminalization. It took from 2016 to now to get a bill. If this bill does not pass, as many people want to kill the bill, we are looking at potentially two, three, maybe four years before we get another one.

TG Branfalt: Well, so in this upcoming election, it’s sort of a big deal for cannabis advocates in Vermont because it appears that Lieutenant Governor David Zuckerman is poised to challenge Phil Scott, a Republican. And anyone who has met Zuckerman knows that he is supportive of legalized cannabis, and he’s an agriculture guy, right? So if this doesn’t pass, wouldn’t the potential election of Zuckerman sort of break that stalemate?

Tim Fair: Well, we have to remember, the executive branch, the governor, we had the legislative branch is passing the laws. Will there be a stronger push from the executive branch and the governor’s office to get something done if David gets elected? Absolutely. Would it be beneficial to getting this done quicker? Absolutely. That is an uphill climb, unfortunately. I know David very well. I would consider him a personal friend. We’ve been friends for quite some time. I’ve supported him in his elections. I’ve turned on phone banking for him when he was running for Lieutenant governor. He’s a great guy. He’s an organic farmer. He is just the right values. But the reality is that Phil Scott, who is a Republican, is a very centralized Republican. He has disavowed Trump, and he has about an 83%, I believe right now, approval rating in how he’s handled the COVID pandemic.

TG Branfalt: 83%?

Tim Fair: 83%, he’s done a good job.

David needs to frame this election properly if he has a chance. And that is yes, Phil Scott’s done a good job and he’s done what any rational sane governor would do, which is listen to the scientists and implement what his department of health is telling him is the safest bet. With Republicans these days, that is incredible in and of itself to run the sentence, but not as anything special as anything that any rational person would do and frame the election is looking into the future.

Okay. Yes, Phil Scott has done a good job. Now, what he has not done is propose or come up or plan for how we are going to recover from this pandemic and from the impact that it’s had. And if David can frame it like that, not looking at the present, but looking into the future, putting forth a strategic plan of which cannabis legalization tax and regularization would be a central part of, I think it has a chance. But of course with everything going on right now, nobody has ever seen anything like this before with what we see in Washington, combined with the pandemic, combined with a uncertainty about what the next 90 days is going to bring between now and the election. I think there’s a lot of variables. And it’s really hard to predict, I think, much harder than in previous elections.

TG Branfalt: How did the local CBD businesses fair during the pandemic that did you guys see a whole lot get sort of shut down or decide to close their doors for good? What’d you see on the ground?

Tim Fair: We have seen a handful of brick and mortar shops closed down for good. Three-month shut down was incredibly detrimental to a lot of businesses. Most of the CBD shops here in Vermont had just sprung up within the last year.

TG Branfalt: Were they considered essential businesses during the shutdown?

Tim Fair: No. So medical cannabis dispensaries were, but CBD stores were not. So there was the brick and mortar shut down. And even now that Vermont is pretty much moved along with our reopening, brick and mortar retail is still taking a huge hit. One of the biggest group of customers for retail here in Vermont are Canadians, a lot of Quebecois and Canadian tourists would come down here to spend quite a bit of money. I would estimate close to a billion dollars a year from Canadian tourists. And of course the border has been shut. So that’s a huge percentage of revenue that has just been completely shut off, has not yet returned. And a lot of people are very skeptical about returning into a brick and mortar shops. So retail in general is taking a huge hit and especially some of the newer CBD stores too have taken a pretty big hit. The people who are doing alright are the ones manufacturing products and doing online sales. Those have seen, if anything an increase.

TG Branfalt: We’ve covered quite a bit of ground here, man. And like we’ve sort of talked about, the last couple of years, you’ve been learning all these new rules, regulations, laws, helping both businesses and individuals in criminal cases, advising businesses, and defending individuals. So right now when it comes to entrepreneurs, what’s your advice for them when it comes to sort of navigating an entirely new set of rules and operations?

Tim Fair: A, have a game plan, a solid game plan. Know why you’re getting into the industry, know what you want to accomplish and then be willing to pivot on a dime. Those are kind of the main rules right now. The successful businesses we’ve seen have had a good understanding of the regulatory framework, know what they can and cannot do and have operated within that framework. Though, businesses we’ve seen that have not been that successful are the ones, well, we’re just going to wing it and see what happens.

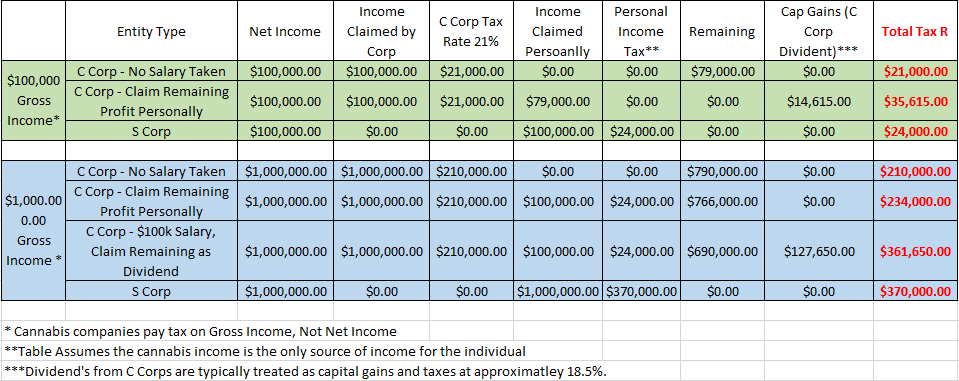

Certain cases, I guess that would be a good plan. In this particular industry, it’s just not right now. And an understanding that there are still a lot of unknowns, understanding of the federal/state conflict, which has created a lot of problems for hemp, CBD, and medical and adult use just straight across the industry, understand 280E, understand the legislative process and that things may not work. These are understandings that if people have and people are willing to listen and learn and incorporate into their business plan. And that brings success. Anything else? People lost a lot of money last year like you know, the hemp industry here in Vermont because they didn’t plan.

TG Branfalt: Yeah. And it was sad to see because it was such a robust industry. Everyone was really, really excited about hemp. And then, even in upstate New York and then the bottom sort of fell out. A, Lack of processing and demand and that sort of thing. And that’s a conversation for another time. So where can people find out more about you more about Vermont Cannabis Solutions, get in touch with you?

Tim Fair: Well, my partner, Andrew Subin, and I will be presenting it in NECANN, New England online cannabis conference, coming up next month, which we’re very excited about. You can find us at www.vermontcannabissolutions.com. And other than that, give us a call. 802-504-weed. We love talking about this all day.

TG Branfalt: Wait, wait, wait. What’d you say the number was?

Tim Fair: Our number. 802-540-weed, 9333. I know. We were really excited when they got us that number too, we didn’t ask for it.

TG Branfalt: You definitely asked for it.

Tim Fair: We didn’t. The customer service guy comes in and he’s got this look on his face and he’s like, “You guys are either going to love this or hate this. But I got you 540-weed.” It was amazing.

TG Branfalt: We should have led with that. One day, I think you’re going to have a Saul Goodman type commercial. It’s just going to be, 802, weed. It’d be fantastic.

Tim Fair: First of all, like we want to stay away from the pot leaves and the whole Bob Marley thing and try to be professional. And then he comes in, and we just could not. We’re like, “All right, we love it. It’s just inevitable.”

TG Branfalt: No, you could have a very straight-laced commercial. And then at the end to be like, “Oh, by the way, our number is weed.”

Tim Fair: I love it.

TG Branfalt: I’m going to produce this for you.

Tim Fair: We’ll be waiting.

TG Branfalt: This is Tim Fair. He’s a Vermont-based attorney, founder of Vermont Cannabis Solutions. They advise canna-businesses in the state of Vermont, and he also defends individuals accused of cannabis-related criminal offenses, super swell guy. Dude, it’s nice to have you on again. And hopefully, it’s not another year.

Tim Fair: TG, great to see you. And hopefully we’ll be able to meet and see in person before too, too long.

TG Branfalt: Thanks man.

Tim Fair: Thanks a lot, brother. Have a good one.

TG Branfalt: You can find more episodes of the ganjapreneur.com podcast in the podcast section of Ganjapreneur.com on Spotify and in the Apple iTunes store. On the Ganjapreneur.com website, you’ll find the latest cannabis news and cannabis jobs updated daily, along with transcripts of this podcast, you can also download the Ganjapreneur.com app in iTunes and Google Play. This episode was engineered by Trim Media House. I’ve been your host TG Branfalt.