Having worked with many medical marijuana growers, processors, and dispensaries in Oklahoma, it has become abundantly clear that the cannabis industry still lacks best business practices and accounting support. As I meet with business owners during my capacity as a c-suite consultant, the stress of the cannabis business is ever-present.

Many operators finished 2018 with high hopes, only to discover the tax bill that awaited them was unlike anything they anticipated! Even those who engaged bookkeepers, accountants, and other “professional” help were caught unaware. As I searched for articles to share with those in the cannabis industry, I quickly realized most were written for peers, not business owners.

This article will detail the issue of accounting, recordkeeping, and taxation for cannabis companies, primarily focusing on dispensaries. A later article will spend time on processors and growers.

The Complexity of the Issue

Basis of the Issue: Cannabis is Federally Classified

Let’s start at the beginning: the causal factor for the cannabis conundrum rests in the fact that marijuana is illegal because it is listed as a Schedule I Controlled Substance under the federal Controlled Substances Act:

Substances in this schedule have no currently accepted medical use in the United States, a lack of accepted safety for use under medical supervision, and a high potential for abuse.

Some examples of substances listed in Schedule I are: heroin, lysergic acid diethylamide (LSD), marijuana (cannabis), peyote, methaqualone, and 3,4-methylenedioxymethamphetamine (Ecstasy).

Because marijuana is still listed as a Schedule I drug, its sale is illegal at the federal level. This is the basis of the conflict for legalization, which affects accounting, which rolls into taxation, and the discrepancy between state and federal government. Cannabis business owners are caught in the grind.

Why are my Business Expenses not Tax Deductible?

Prior to the state legalization of marijuana, 280E was a largely inconsequential IRS rule. IRS 280E specifically deals with taxpayers who sell Schedule I or II drugs as a business and essentially states that the federal government does not see the business as legal and does not allow for expenses (rent, salaries, utilities, etc.). Instead, the government only allows for something called Cost of Goods Sold (COGS). Cost of Goods Sold, specifically, is the cost of what was purchased to resell (flower, edibles, etc…). For dispensaries, this is the cost you paid for the product (plus shipping, if applicable). No other costs are allowed to be used to reduce your income subject to tax.

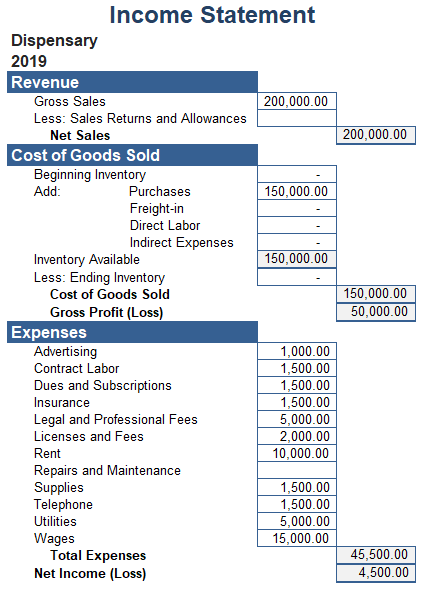

As detailed in Table 1 below, most businesses in the US would expect to pay income taxes on the Net Income (at the bottom of the table) of $4,500.00. The Net Income is (Net Sales – Cost of Goods Sold – Expenses).

Cannabis businesses, however, ARE NOT taxed like other businesses in the US. Based on IRS 280E, they are NOT allowed to deduct any costs other than the cost of their product (Cost of Goods Sold). Therefore, cannabis businesses will be taxed on Gross Profit (Net Income – Cost of Goods) of $50,000.00! That is a major difference in tax liability that results in taxes being charged on $50,000 versus $4,500.

Business Setup – Can it Help?

There are a few ways to go about establishing (setting up) your company. It is important to know the difference between the corporate structures as well as the difference between state and federal designations.

IRS (Federal) Designations

Regarding taxation, there are essentially two types of classifications: Taxable Entities and Passthrough Entities. There are also two types of Corporations: C corporations and S corporations. For the purposes of taxation, C corporations are significant because they are legal entities that are separate and distinct from their owners.

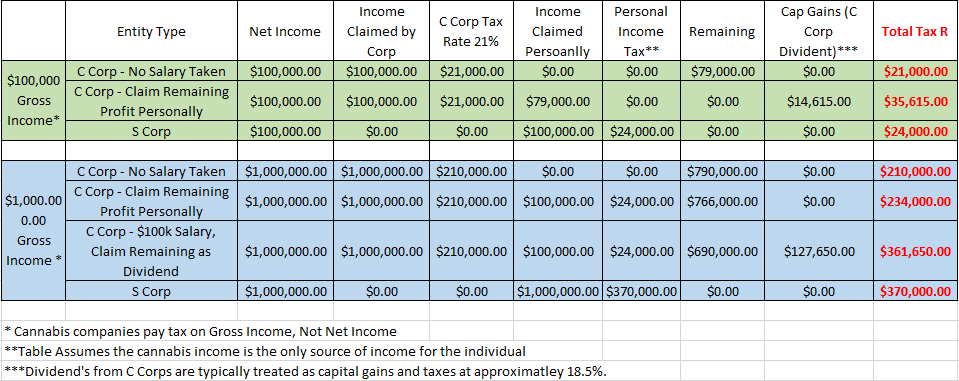

Initially, accountants and attorneys advised cannabis clients to set up as C corporations. This was primarily due to the difference in tax rates between C corporations and other types of tax entities.

Because cannabis businesses are paying taxes on such a larger amount (Gross Profit, not Net Profit), C corporations offered some advantage. The corporate tax rate is approximately 20% (actually 21%), while the highest personal tax rate is around 37%. Below is a demonstration of the tax differences between the two methods.

Recordkeeping and Accounting

Good Recordkeeping

The breaking points in the cases that have gone to trial have largely come down to poor record-keeping. In business, if it is not documented, it did not happen! (Especially to the IRS).

From a ruling in Alterman V Commissioner, TC Memo 2018-83, the court viewed the lack of separation of separate services as an “after the fact” attempt to make one business look like two businesses. Good bookkeeping would have allotted revenue to each service, along with the expense (Cost of Goods) incurred to earn the revenue.

Good recordkeeping costs more! It may require two sets of books, two business setups, and two tax returns if the businesses are run separately. The extra costs MAY be very small compared to the benefits.

Regardless of the type of business you choose to set up, good record-keeping is paramount for audit readiness!

Job Descriptions

Vertically integrated cannabis businesses (those who own both grow and dispensary; grow and processing; or grow, processing, and dispensary operations) have some advantages over simply owning a dispensary (as will be discussed later).

However, in keeping with good record keeping, these companies need to invest the time (or money, if you would like to outsource it) to write good job descriptions. It will not be sufficient to say, “I have a person who works the dispensary, so I pay them for that. Also, they work in processing, so I pay them for that as well.” The IRS may well deem all the salary costs to the dispensary, where labor IS NOT a part of Cost of Goods therefore it doesn’t reduce the dispensary’s revenue.

Detailed job descriptions as well as documented work hours, by job or process, will be of huge benefit during an audit.

Accounting and Taxation

Proper accounting is the gateway to proper taxation. Tax preparers utilize accounting to determine taxable income. Tax preparers are charged with assimilating data into a properly filed tax return, based on the information given to them.

If COGS are incorrect from accounting, they will be incorrect on the Tax Return. For cannabis, accounting, simply stated, is a service you cannot afford to be without.

Knowing what items are allowed to be part of COGS for dispensaries is THE major hurdle to having proper and accurate accounting. Only inventory purchases and shipping for inventory to your dispensary are allowed as COGS items for Dispensaries.

Items not allowed under COGS for dispensaries include:

- Rent

- Salaries

- Contract Labor

- Storage

- Display Cases

- Utilities

- Insurance

- Professional Fees

- Licenses and Fees

Audit and Audit Ready

The chance of a business getting audited in the US is approximately 1.5%. This number fluctuates from year to year but remains relatively stable. For marijuana business operators, the chance of an audit has been reported as high as 10 to 15 percent, according to the Cannabis Business Professionals of Oklahoma.

While getting audited can be intimidating, being properly prepared is key. If you have invested the time in choosing an accounting firm that is familiar with marijuana businesses, gives you sound advice on what you may and may not deduct, and prepares solid financials (thus, data for your tax return), you will come through the audit just fine. Again, preparation is key! Remember: of the major cases that have been tried, most noted poor bookkeeping and accounting as contributing factors to higher taxes, leading to penalties and interest costs.

Conclusion

In review, cannabis dispensaries are only allowed to deduct Cost of Goods Sold (COGS) from net revenue to determine the business’ taxable income attributable to the owners. The lack of proper classification for Cost of Goods Sold purchases (inventory and shipping of inventory to the dispensary) can lead to a massive increase in the already-high tax exposure facing cannabis dispensaries.

Remember, typical business expenses (operating expenses) are not allowed for cannabis dispensaries in regard to taxation. Cannabis businesses pay taxes on the profit left after the purchase of the product. Storage, shelving, rent, insurance, and other normal business expenses are not taken into consideration for federal (and Oklahoma state) taxation.

End